In late October, Pacific Investment Management Company (PIMCO), a leading American investment management firm renowned for its strength in fixed-income markets, made waves with its announcement of raising a staggering $2 billion for a new asset-based finance strategy. This fund will focus on areas such as luxury-based lending and asset -based finance, as well as delve into consumer debt, including credit-card receivables and non-consumer loans. PIMCO’s latest initiative underscores a broader trend—financial firms are increasingly embracing the burgeoning private-credit market, with asset-based finance, also known as specialty finance, fast emerging as the next frontier in investment.

Private credit—also referred to as private debt—represents a transformative shift in how financing is provided, particularly to small and medium-sized businesses (SMBs) that are often underserved by traditional banks. Unlike public markets, where fixed-income assets such as corporate bonds are traded openly, private credit is issued privately and is not traded on public exchanges. This sector offers an array of opportunities for borrowers, lenders, and investors alike, and its growth trajectory remains nothing short of remarkable.

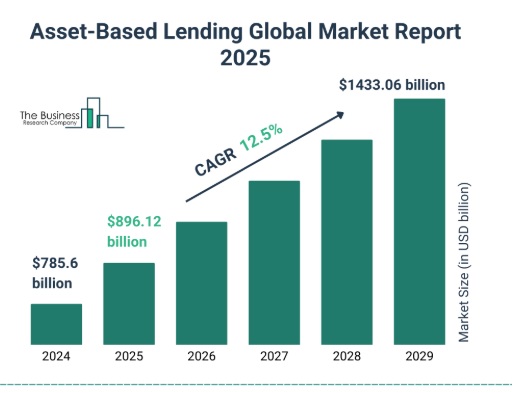

(CAGR – compound annual growth rate)

The Appeal of Private Credit

Private credit brings a unique set of benefits to the financial ecosystem. For borrowers, it provides an essential alternative to traditional bank loans, particularly when conventional banks may be hesitant or unable to provide the necessary funding. This flexibility is a key advantage, with tailored loan sizes and timely transactions that align closely with borrowers’ needs.

Asset-based finance lenders in this space include private-credit funds, private-equity firms, hedge funds, and other institutional investors. Major players such as Blackstone, Apollo Global Management, Ares Management, and Blue Owl Capital have already cemented their status as powerhouses in the sector. Apollo, for instance, manages an astounding $700 billion in assets, with over $500 billion attributed to its credit business alone. With private-credit markets offering substantial premiums—sometimes as much as 300 basis points over other fixed-income segments—lenders are reaping the rewards of this less-regulated, higher-return space.

On the investor side, institutional entities, including pension funds, insurance firms, and sovereign-wealth funds, are increasingly looking to private credit as a high-yield alternative to traditional fixed-income strategies. While private credit still accounts for a relatively small percentage of the total debt held by private companies (around 15 percent), it has grown dramatically since the Global Financial Crisis (GFC) of 2007-2009. As Federal Reserve economists Ahmet Degerli and Phillip Monin noted, private credit is now a vital source of capital for businesses, with outstanding volumes comparable to leveraged loans and high-yield corporate bonds.

A Boom in Asset-Based Finance Markets

The resilience and outperformance of private credit are apparent as traditional debt markets, particularly public fixed-income assets, have faced challenges in recent years. With declining bond prices and soaring yields, private credit has flourished, attracting hundreds of billions of dollars in assets. According to Morgan Stanley, global assets under management (AUM) in private credit were estimated at $1.5 trillion at the start of 2024—an impressive 50 percent increase from 2020. Forecasts from BlackRock suggest the private-credit market could reach a staggering $3.5 trillion by 2028.

This meteoric rise signals a seismic shift in the financial landscape, as nonbank lenders are increasingly taking market share from traditional banks. The move from banking to nonbanking lenders, where savers are acting as lenders, appears to be a long-term trend. Greg Olafson, Global Head of Private Credit at Goldman Sachs Asset Management, aptly explains that this transition is reshaping the industry, offering better business models and more efficient asset-liability matching.

Strategic Partnerships and the Future of Private Credit

As private credit continues to evolve, banks are recognizing the value of collaborating with private-credit managers to tap into the sector’s outsized returns and fees. By partnering with firms like Blackstone, Apollo, and Brookfield Asset Management, banks are positioning themselves to offer superior service to their corporate clients, particularly when it comes to asset-backed lending (ABL). This collaboration benefits both parties: banks retain strong client relationships, while asset-based finance firms gain access to valuable borrower networks.

PIMCO’s latest foray into asset-based finance lending highlights this growing sector’s potential. Describing it as the “next frontier” in private credit, PIMCO points out that asset-backed lending (ABL), often secured by tangible assets, offers attractive and reliable returns. With applications spanning residential mortgages, consumer credit, and non-consumer lending, asset-based finance is becoming a critical source of funding across the global economy.

Overcoming Challenges and Seizing Opportunities

While the private-credit market has experienced spectacular growth, it has not been without its critics. Some voices within the traditional banking industry caution against the risks associated with private credit, especially in times of economic stress. JPMorgan Chase’s CEO Jamie Dimon warned that companies relying on high-interest private credit could face severe challenges in a rising-rate environment.

However, despite these concerns, the underlying strength of asset-based finance continues to shine. In particular, direct lending—the provision of secured or unsecured loans to borrowers—has shown impressive resilience, offering higher returns and lower volatility compared to leveraged loans and high-yield bonds, particularly in high-interest-rate environments. Morgan Stanley’s Ashwin Krishnan pointed out that direct lending has yielded average returns of 11.6 percent during periods of rising rates, far outpacing other fixed-income assets.

As asset-based finance continues to evolve, its ability to adapt and provide tailored, flexible solutions to both borrowers and investors makes it one of the most compelling asset classes in the market. The sector’s outperformance is expected to persist well into 2025 and beyond, positioning it as a key driver of growth in the financial landscape.

Conclusion: The Bright Future of Private Credit

The rise of private credit represents not just a trend, but a transformative shift in the global financial ecosystem. As investors, lenders, and borrowers alike continue to embrace this rapidly growing sector, the opportunities are vast and varied. With its attractive returns, flexibility, and diversification potential, private credit is poised to be a cornerstone of investment strategies for years to come. As financial markets continue to evolve, the asset-based finance and private-credit space will undoubtedly remain a beacon of opportunity in a rapidly changing world.

[Learn more about LQD’s role in asset-based finance here.]

0 Comments